By Herman Kumara | Praja Abhilasha, Sri Lanka

Sri Lankan southern beach seascape. https://www.stockvault.net/photo/280427/sri-lanka-southern-beach-seascape

Sri Lanka was known worldwide as the pearl of the Indian Ocean, but that pearl has shattered into pieces thanks to almost 3 decades of civil war followed by the current food, fuel, energy, and finance crises. And the crises culminated in the April 2022 declaration of bankruptcy by the Government of Sri Lanka. The declaration of bankruptcy meant that we could no longer pay back our loans from foreign and local lenders, and international finance institutes.

How did this happen to a country rich with natural resources: land, sea, forests, unpolluted air, and abundant with biodiversity? Didn’t we have everything we needed to be self-sufficient and independent? And Sri Lanka is a country where a high percentage of the country is educated and we maintain a democratic system. We need to study why this has happened in a country that had everything it needed to be prosperous.

Sri Lanka became politically independent from British colonizers in 1948. We celebrated our 75th Independence Day this past February. Although we received political independence, we were not economically independent and continued to depend on foreign countries for “so called” development programs. It is important to note that we had a surplus budget when the British Colonizers left the country in 1948. However, the surplus didn’t last long. When the country adopted neo-liberal economic policies, a shift towards free trade, deregulation, and privatization, in 1978, we began to experience budget deficits.

Sri Lanka External Debt – we see a sharp upward trend since 2005. Source: https://www.macrotrends.net/countries/LKA/sri-lanka/external-debt-stock

After the adoption of neo-liberal policies, the whole country became a dumping site for foreign imports and our long history of local production totally collapsed. We spent a lot of foreign currency on imports from agricultural products to fish, from nails to motors[1], from education items to books.

Foreign debt has increased annually since 2022. But if you notice in the chart below, external debt doubled between 2005 and 2010, and then again from 2010 to 2015.There are many factors that have contributed to the debt load of the country. The primary factor is the lack of promotion of local production, which includes a lack of incentives for local producers, and a lack of policies that favor or prioritize local markets and local consumption.

Sri Lanka External Debt – Historical Data. Source: https://www.macrotrends.net/countries/LKA/sri-lanka/external-debt-stock

It is very important to learn why we face this situation of finance, food, fuel and energy crisis lead to a bankrupt country. We can see external and internal factors lead to this situation.

External Factors:

- Pandemic effect

- Russia-Ukraine war-induced inflation

- Fuel price hike in the global market

- Sharp decrease in foreign direct investments

Internal Factors:

- Concentration of power under executive presidential system

- Crises of agriculture and fisheries sectors due to adoption of open market system and failure to promote local production

- Shortage of foreign reserves

- Irrational policy decisions

- Fancy development projects that don’t benefit local communities

- Nepotism and corruption

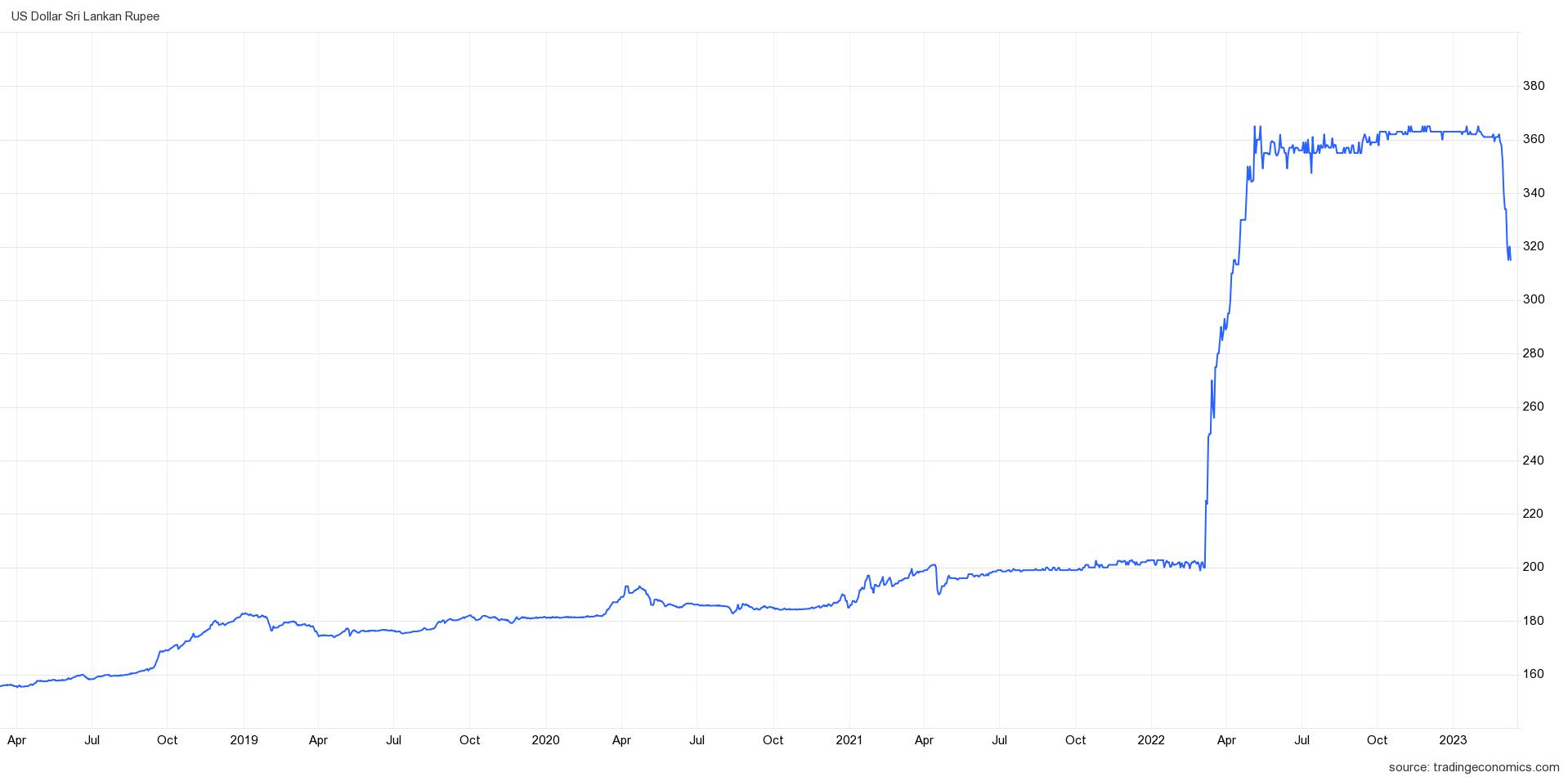

- Devaluation of the Sri Lanka Rupee against the US dollar

We can see that the Sri Lankan Rupee has depreciated dramatically since the April 2022 bankruptcy against the US dollar. Source: https://tradingeconomics.com/sri-lanka/currency

It has been the experience of Sri Lanka, that once we approach foreign companies, international finance institutes, bilateral lenders for loans, we are then obligated to follow their terms and conditions to pay back the loans which are never in favor of the local economy, nor local development, nor enhancing the quality of local production, nor ensuring local food security, including security of local agricultural and fishery production, nor developing local industrial production. Taking on the foreign loans entails dependency on foreign inputs, including equipment, materials, and even labor from the lending countries for the development work implemented. And the case of Sri Lanka has been particularly complicated by corruption and nepotism, where fancy development projects were implemented without clear direction of national interests to benefit the elite ruling families rather than the hardworking citizens of Sri Lanka.

As the neo-liberal economic policies are promoting import/export economies, the economically poor countries like Sri Lanka cannot overcome the current crises without having a production economy. The creditors are promoting the importation of products and open markets, devaluation of local currency, free trade policies, concentration of powers, increasing oppression under draconian laws that suppress people’s voices. These policy shifts will not help Sri Lanka to overcome the burdens the current debt and political crisis. We need to take a firm stand to promote local producers, enhance the quality of local production, and transform our economy from an import economy to a producer economy to overcome the burden. The shift will be painful, and there will be difficulties for some period of time, but this is what we must do to move away from growing foreign dependence to self-sufficiency and prosperity. We need brave political leadership and strong policies that prop up local development and production to win this battle.

The work of the Presbyterian Hunger Program is possible thanks to your gifts to One Great Hour of Sharing.

[1] Prior to 1978, we produced and exported cars. However, this production was disrupted once foreign vehicles were imported without further developing local production.